The English version of "2025H1 Luxury Brands in China Power Ranking" by LUXE.CO (56 pages) is now available to download (only accessible by LUXE.CO subscribers).

Click here to download the report

As we approach the midpoint of 2025, the past six months have seen significant challenges for luxury industry. Still,there is no clear indication on when China's luxury market will truly recover and rebound.

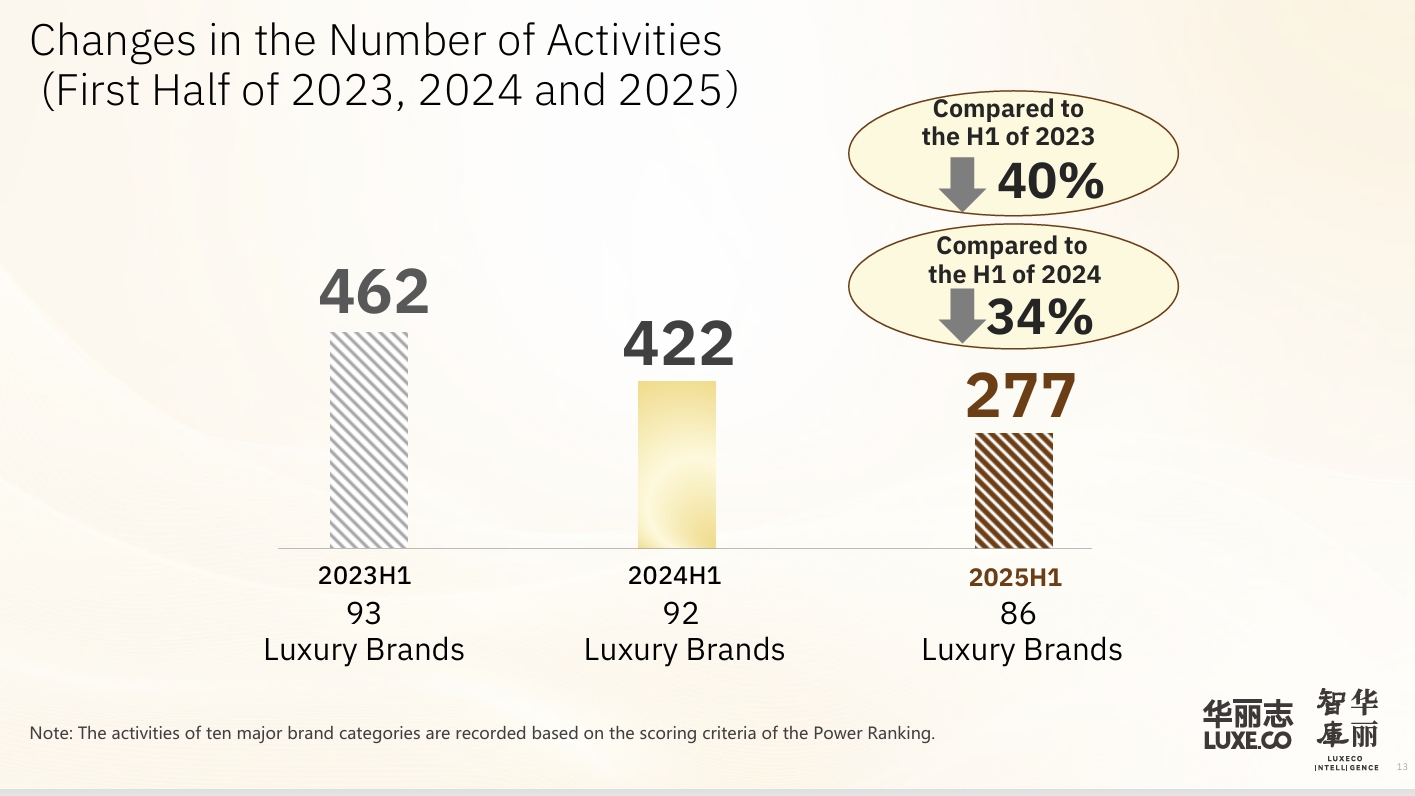

As shown by data tracked by LUXECO Intelligence, the research and consulting arm of LUXE.CO, the momentum of China's luxury market has generally weakened in the first half of 2025, with the total number of brand activities declining by a significant 34% year-on-year. However, luxury brands have continued to finetune their operations, with more focus on core customer base; in terms of marketing, they have placed greater emphasis on differentiated content creation and better precision communication.

We have observed that some brands with better "resilience" and "foresight" have maintained a steady pace of progress with investment increased in a more creative manner, aiming to capture more consumer mindshare and market share during the downturn.

After over two decades of rapid growth, China's luxury market is entering a historic period of adjustment. Facing the significant fluctuations in spending of "aspirational customers", the maturation core customers, the shift in public sentiment, as well as the rise of domestic Chinese brands, international luxury brands must rethink their long-term strategies and short-term tactics:

— Have brands been too focused on the exposure of celebrities while neglecting their own content developmen for marketing and communication?

— Have product innovation and R&D kept pace with the times, effectively conveying the "value proposition" of a luxury brand and demonstrating market leadership?

— As Chinese consumers become more mature and sophisticated, does the brand's in-store experience and service quality meet their expectations? Can the brand create genuine surprises and resonate with their consumers?

—Do global and local management truly understand the nature of current China market and prepare themselves well for the “new normal”?

Exclusively produced and released by LUXE.CO for four consecutive years, "Luxury Brands in China Power Ranking" has become more and more valuable for the management of global luxury brands in understanding the competitive environment of China luxury market.

The newly released "2025H1 Luxury Brands in China Power Ranking" covers 277 activities from 86 luxury brands between January 1 to June 30, 2025, spanning ten categories of marketing and channel expansion (excluding activities related to the beauty, skincare, fragrance, eyewear, and hotels business of luxury brands).

Through this unique industry ranking, you will gain an intuitive understanding of which luxury brands remained committed to China's market and bucked the trend in the challenging first half of 2025, particularly in comparison to the first half of 2024. You will also discover which cities saw the most new-store openings, and what new strategies and trends were revealed by luxury brands' major events in China.

Click here to download the report

(only accessible by LUXE.CO subscribers)

Highlights

Compared to the first half of 2024, the number of luxury brands with significant activities in the first half of 2025 decreased from 92 to 86. Meanwhile, the total number of activities across all luxury brands in the first half of 2025 decreased by 34% compared to the first half of 2024, and by 40% compared to the first half of 2023.

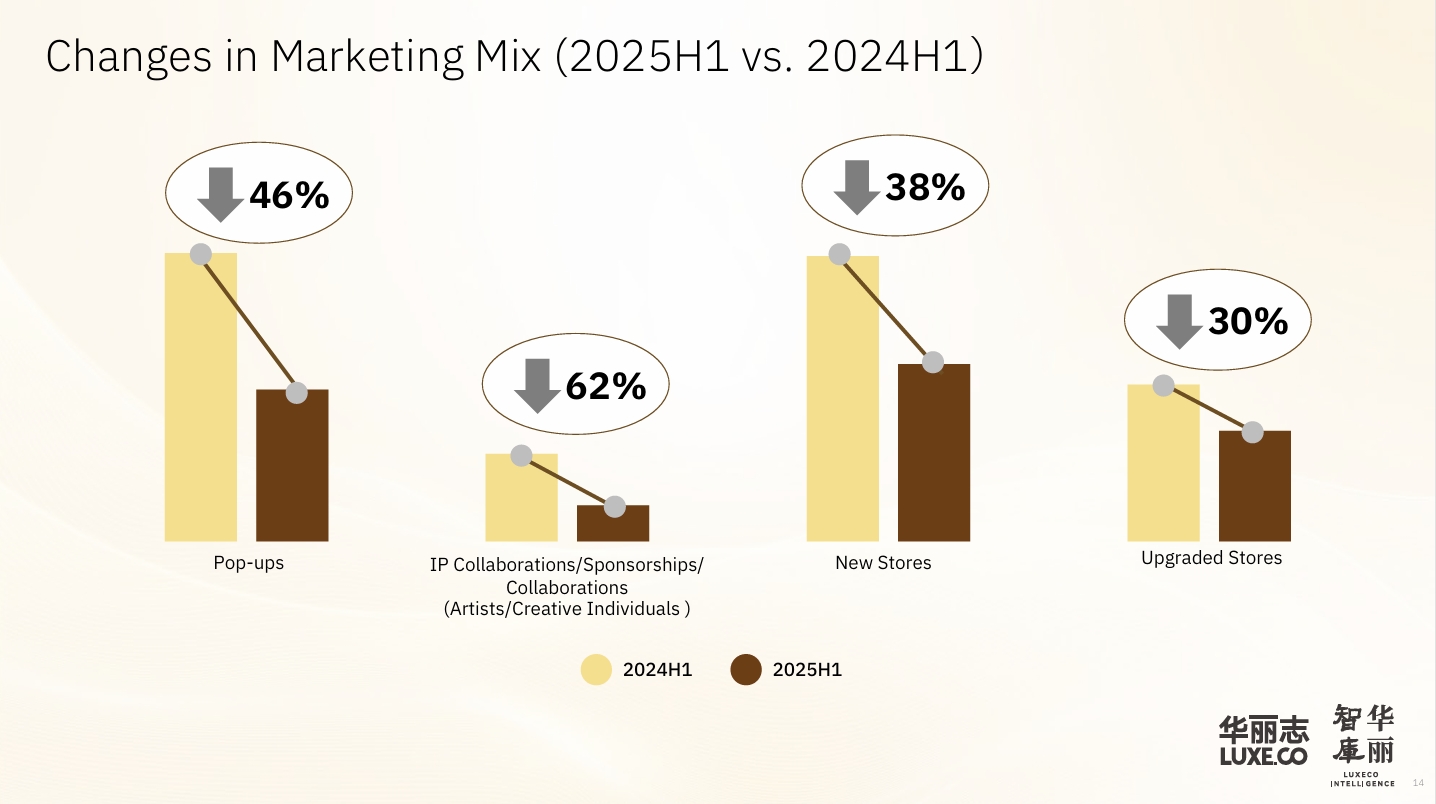

Among these, the number of activities related to new store openings, store renovations, and pop-up stores all decreased by more than 30%.

Notably, Gucci and Bottega Veneta saw the largest declines in the number of activities in China's market, with their rankings dropping from the 3rd and 7th place in the first half of 2024 to the 19th and 22nd place in the first half of 2025.

Dior is undergoing its biggest overhaul of design and merchandise in a decade. With Jonathan Anderson taking full control of creative direction in June, we may see more new vitality and momentum injected into the brand.

In the current sluggish market, some luxury brands remain committed to and are efficiently investing in China's market, bucking the trend and rising in the Power Ranking.

For example, the following luxury brands have newly entered the TOP 10 of the Power Ranking: Ralph Lauren, Loro Piana, Qeelin,MiuMiu,Van Cleef & Arpels.

Ralph Lauren, which rose from the 33rd place in the first half of 2024 to the 8th place in the first half of 2025, enjoyed the biggest rise of all brands on the "Power Ranking".

Hot on its heels, coming in close second is Brunello Cucinelli, which rose from the 33rd place to the 12th.

Whenever the luxury industry faces difficulties and challenges, there is always one "exception" that stands out -- Hermès, which has always been relatively "low-key" comparing to other top players.

However, in recent years, LUXE.CO has observed that Hermès has steadily accelerated and intensified its marketing efforts, especially in current situation. Not only has the brand hosted more offline pop-ups, exhibitions, workshops, and preview events for men's and women's collections, it has also continued to upgrade its stores. Additionally, the brand's social media posting frequency has increased significantly.

In this regard, the Power Ranking provides quantitative evidence of Hermès' trajectory in China's market: rising from the 20th place in 2022 to the 4th place in 2025H1.

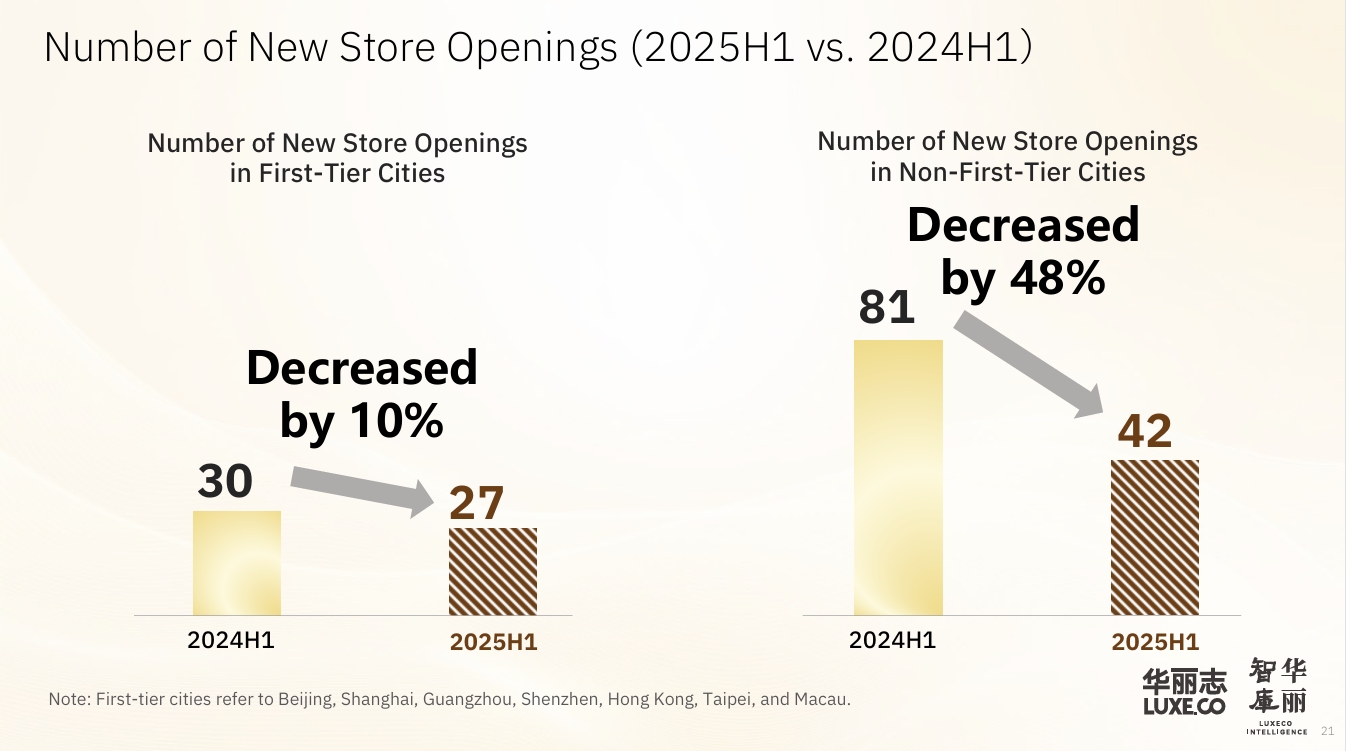

Geographically speaking, the decline of activities of luxury brands in second-tier cities is notably greater than in first-tier cities. For instance, the number of new stores opened in first-tier cities decreased by 10% year-over-year, whereas the decline in non-first-tier cities was 48%.

About Luxury Brands in China Power Ranking

The ‘Luxury Brands in China Power Ranking’ is a comprehensive and systematic collection of the latest business activities of major luxury brands in China’s market over the past year (or six months). It objectively assesses the importance and influence of each activity and conducts a unified weighted scoring to comprehensively present the investment and vitality of luxury brands in China’s market.

Click here to download the report

(only accessible by LUXE.CO subscribers)

How to become a LUXE.CO subscriber:

Please go to the Apple or Android mobile app store to download the ‘ 华丽志’ app, or visit our Chinese website ( luxe.co ); log in, register and purchase a subscription. As a subscriber, you will be able to read all historical articles from LUXE.CO and exclusive content for subscribers, and enjoy all the research reports published by the LuxeCO Intelligence. (For more details, please go to: https://luxe.co/subscriber)

About LuxeCO Intelligence

LUXECO Intelligence is a unique research and consulting service platform for the global fashion industry. Based in China, it provides forward-looking consumer insights, industry research, and strategic advisory services with a broad global perspective and in-depth industry insight.

Focusing on the luxury goods, sports and outdoor, fashion accessories, beauty and fragrance, and lifestyle industries, LUXECO Intelligence leverages its continuously developed industry network, data intelligence, and knowledge system. We provide industry leaders with the best decision-making references through structured business information, systematic industry-specific research, efficient primary research, rich practical case studies, and forward-thinking strategic insights.

To check all reports by LUXECO Intelligence https://luxe.co/page/hlzk

Email:lci@luxe.co